Content on this page:

How to get started

Register for Online Banking

To use Fast Payments, you will first need to register for Online Banking.

Find out more about Online Banking and call us on 1300 131 844 to register or visit a branch and we’ll guide you through the process.

Make sure your contact details are up to date

Ensure that your details, including mobile number and email address, are up to date before using Fast Payments.

If you need to update your mobile number that is attached to your SMS One Time Password, you will need to visit a branch or call our Contact Centre on 1300 131 844 to update this contact information.

Check and update your contact details through Online Banking:

- Log in to Online Banking

- Select the Settings tab and then Update Contact Details

- A SMS One Time Password will be required when updating your contact details. Click Get SMS and type this verification code into the Enter your One Time Password field, then select Ok

- Update your mobile number or email address

- Select Update details.

Now you’re ready to set up your PayID for the first time.

Check and update your contact details through the Banking App:

- Log in to the app

- Select the Hamburger Menu in the top left corner (the three horizontal lines)

- Select My Details then tap Contact Details

- A SMS One Time Password will be required when updating your contact details. Click Send SMS type this verification code into the SMS Code field and select Continue

- Update your mobile number or email address

- Select Update details.

Now you’re ready to set up your PayID for the first time.

Set up your PayID for the first time

Simply follow these steps:

Using Online Banking

- Log in to Online Banking

- Select the Settings tab and then Manage PayID

- Select the required contact from the drop-down list or select Add or Update Contact Details if the details you need are not listed already. A SMS One Time Password will be required when adding a new contact

- If you added new contact details make sure to select Update Details then scroll to Create PayID to finish updating your PayID.

Link your PayID to your account with these easy steps:

- In the Create PayID screen, make sure you’ve selected the required contact from the drop-down list

- Choose an account from the Link PayID to Financial Account drop-down

- Then click Get SMS or Get Email – a new verification code (One Time Password) will be sent to your selected mobile or email address

- Type this verification code into the Enter your Verification Code field

- Click the link to read the Terms and Conditions of Use and select Yes to confirm

- Click Create

- You will then be returned to the Manage PayID screen where the newly created PayID will appear in your list.

Now you’re ready to share your PayID with others and be paid without having to share your BSB and account number.

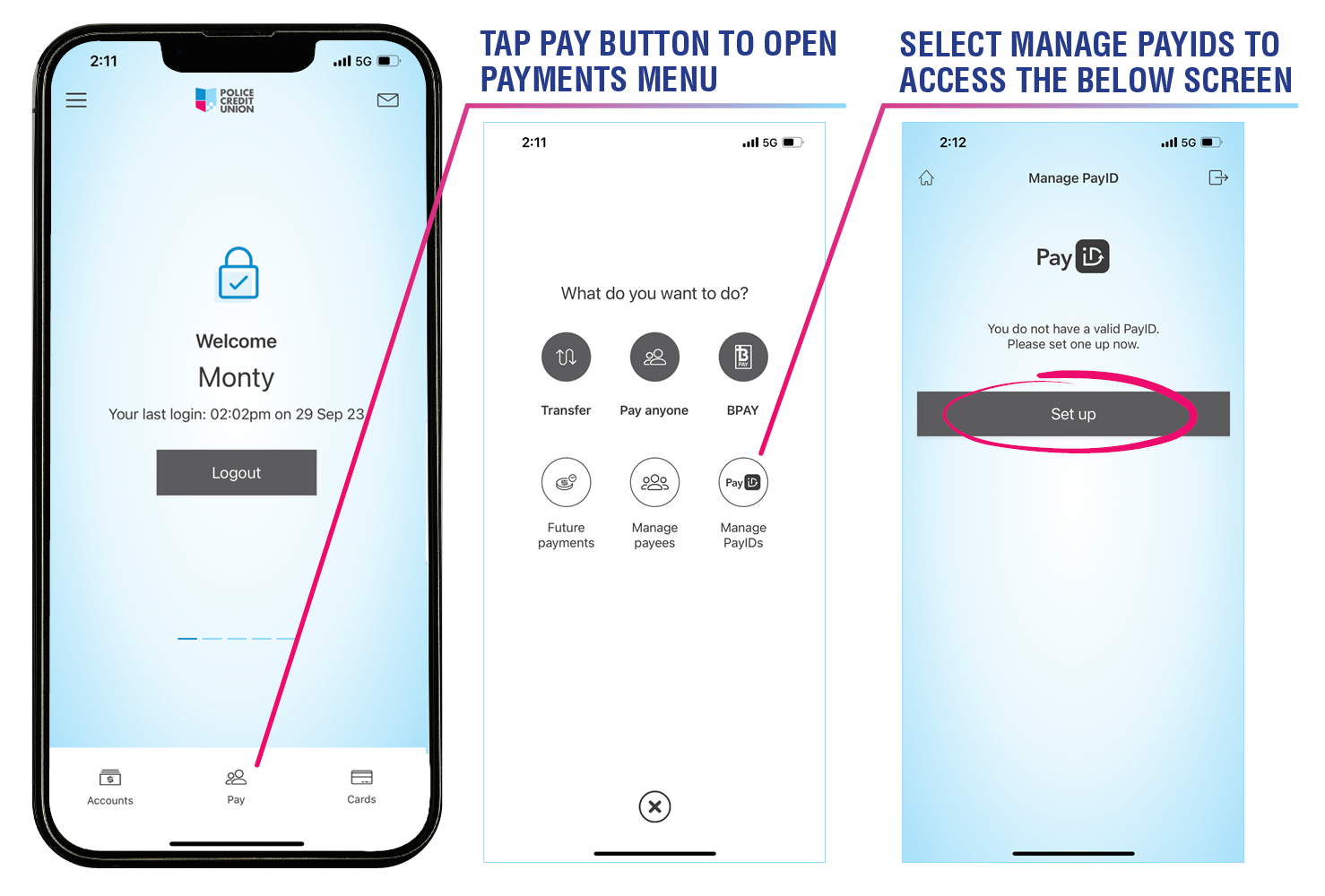

Using the Banking App

- Log in to the app

- Select Pay from the bottom menu

- Select Manage PayIDs

- Select Set up

- The PayID name will be displayed. This cannot be changed and is based on the name that is recorded against your membership. Note: the PayID name will be displayed when other people use your PayID to send you a payment, to verify they have entered the correct email or mobile number

- Select a mobile number or email address from the list

- Select which account you would like your PayID linked to. Note: the account selected is where transfers to your PayID will be deposited into

- Select Save

- Please read the Terms and Conditions. Then select Accept

- Click Send SMS or Send code to email – a new verification code (One Time Password) will be sent to your selected mobile or email address

- Type this verification code into the SMS Code field and select Continue.

To set up your PayID using an ABN or an organisational name, call us on 1300 131 844 or visit a branch. You cannot do this via Online Banking or our Banking App.

Remember that, although you can have multiple unique PayIDs with different financial institutions, each PayID can only be linked to one account.

Set up a new payee using their PayID

Set up a new payee through Online Banking:

- Log in to Online Banking and select Payments

- Choose Payees, then select New Payments Platform Payee from the Add New Payee drop-down

- From the transfer method options select either Email Address or Phone Number depending on what details you have been provided

- Fill in their PayID details

- When you click into the next box, their PayID name will appear, check the Payee name matches the person you’re transferring money to, if it does continue completing their details

- Click Get SMS – a new verification code (One Time Password) will be sent to your mobile

- Type this verification code into the Enter your One Time Password field and select Save.

Once you have set up a new payee using their PayID, you will be able to transfer funds using the payee’s unique PayID identifier by going to Payments and then Transfer Money.

While in the Transfer Money screen, you can also select the New Payee button from the ‘To’ dropdown and follow step 3 onwards in the Set up a new payee through Online Banking instructions above.

Set up a new payee using the Banking App:

- Log in to the app

- Select Pay from the bottom menu

- Select Manage payees

- Tap New and select either Email address or Mobile number depending on what details you have been provided

- Fill in their PayID details and select Validate

- Check the Payee name matches the person you’re transferring money to, if it does select Save.

- A SMS One Time Password will be required. Click Send SMS type this verification code into the SMS Code field and select Continue

Once you have set up a new payee using their PayID, you will be able to transfer funds using the payee’s unique PayID identifier by selecting Pay and Pay anyone or by selecting the hamburger menu (the three horizontal lines in the top left corner) and selecting Transfers & Payments and choosing Pay Anyone.

* Before you can set up a payee using their PayID, they will need to have registered it with their financial institution.

If an Osko® payment isn’t possible, then you will see the words Standard Transfer appear. If this is the case, funds may take up to three business days to transfer.

Don’t forget, you still have the option of using a BSB and Account Number to complete a transfer. Where accounts are reachable through the New Payments Platform, we’ll send it as a Fast Payment, otherwise it will be sent as a standard transfer.

Sending a payment

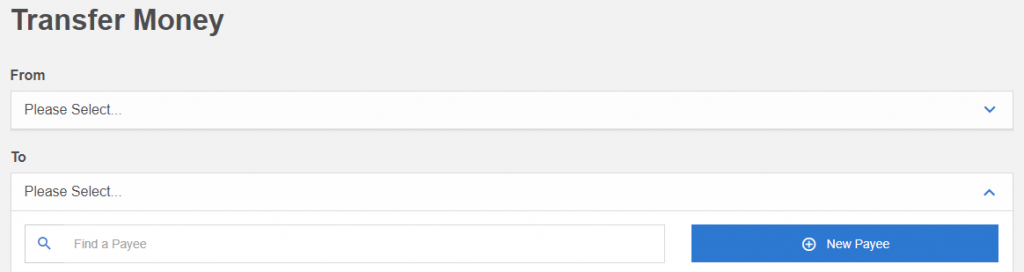

Fast Payments in Online Banking

Select Payments and then Transfer Money, select an existing payee or add a new payee PayID using the instructions above.

Fast Payments in Online Banking looks like this:

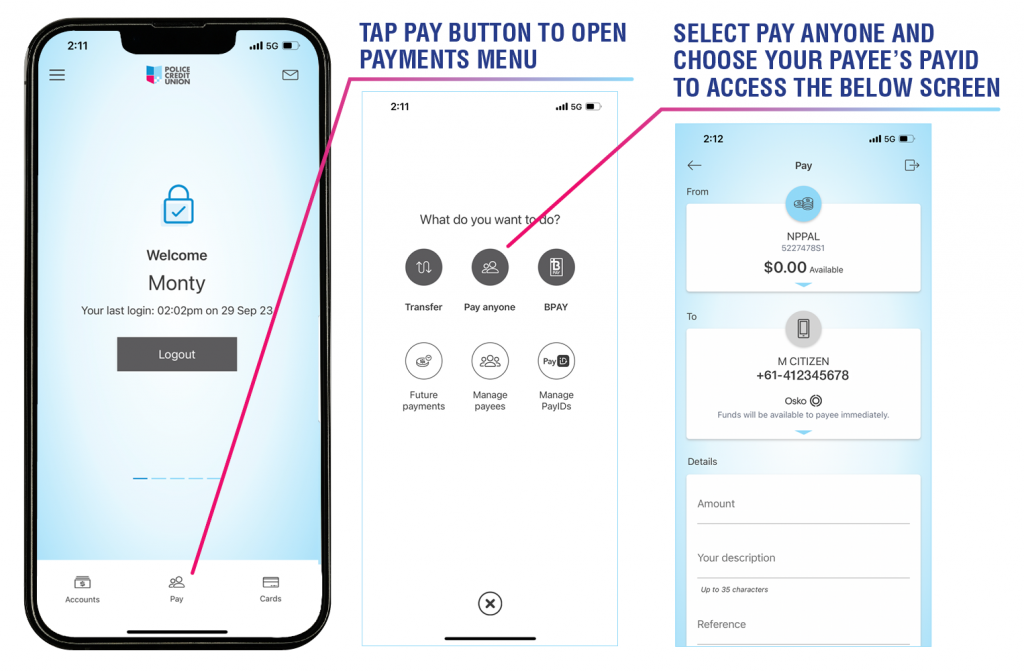

Fast Payments in the Police Credit Union Banking App:

Log in to the Banking App and follow these steps:

- Select Pay from the bottom menu menu then select Pay anyone

- Choose your desired payee and complete the transfer details as usual.

Make a Fast Payment via the Accounts menu:

- Select the account that you wish to transfer money from

- Then select Pay

- Select Pay anyone then select your desired payee and complete the transfer details as usual.

Make a Fast Payment via the hamburger menu:

- Tap the hamburger menu (the three horizontal lines in the top left corner)

- Select Transfers & Payments

- Select Pay Anyone

- Either select an existing contact or add a new payee PayID using the New button.

Fast Payments in the Banking App looks like this:

Make changes to your PayID

Make changes to your PayID by using Online Banking and the Banking App. You can:

- Change the linked account

- Transfer the PayID to another one of your accounts

- Transfer the PayID to another financial institution

- Close the PayID.

Remember, if you close a payID but you wish to use it again, you will need to recreate your PayID and a SMS One Time Password will be required.

Change your PayID using Online Banking

- Log in to Online Banking

- Select Settings and then Manage PayID

- Select an existing PayID that you’d like to edit

- From the drop-down choose how you’d like to edit your PayID

- Select Get SMS – a new verification code (One Time Password) will be sent to your mobile

- Type this verification code into the Enter your One Time Password field and select Transfer or Close or Update (depending on how you’re editing your PayID).

Change your PayID using the Banking App

- Log in to the Banking App

- Tap the hamburger menu (three horizontal lines in the top left corner) then select My Details

- Select My PayID and choose PayID you’d like to edit

- From the Status menu choose how you’d like to edit your PayID and tap Save

- A SMS One Time Password will be required. Click Send SMS type this verification code into the SMS Code field and select Continue.

We’re here to help

If you have questions or need some help, call us on 1300 131 844 or visit us in branch.