What is Open Banking?

Open Banking or the Consumer Data Right (CDR), refers to legislation passed by the Australian Government which will give you greater access and control over the data that financial institutions hold about customer details, account information and transaction history.

The aim of the Consumer Data Right is to improve a consumer’s ability to compare and switch between products and services, encourage competition between service providers, which should lead to more competitive pricing, and the development of innovative products and services. It will also allow consumers to safely transfer their banking data to trusted parties.

Under the CDR legislation and rules, Police Credit Union is required to share certain data it holds about products currently offered and products which a customer holds with Police Credit Union.

Consumer Data Sharing and Access to Data

Consumer Data Sharing involves sharing publicly available and generic information about Police Credit Union’s product rates, fees, terms and conditions across deposit products, savings/transactional accounts, loan and credit card products via a Product API (Application Programming Interface).

From 1 November 2021, Customers can also access their CDR data through third party service providers accredited to offer services under the CDR, called Accredited Data Recipients (ADRs). This phase of Open Banking will allow Police Credit Union to share customer data with ADRs directly.

Consent

Customers will need to give an ADR / accredited third party their consent to collect CDR data from Police Credit Union. The ADR will notify Police Credit Union and we will reaffirm this consent with our customers prior to sharing CDR data with the ADR. To confirm consent, we will determine the details of what is being shared and verify your identity using a One Time Password sent via SMS.

IMPORTANT: Police Credit Union will NEVER ask you for your Online Banking password with a third party.

How long does consent last for CDR?

Customers can choose to authorise once-off access to their data OR allow ongoing consent to the ADR for a period of up to 12 months.

How will Open Banking benefit you?

Open Banking may benefit you in various ways including:

- Having a single view of your finances, especially if you use multiple financial institutions

- Being able to compare rates and features of loans, savings and credit products more easily, to make the process of finding a suitable product or deal easier or determining a budget

- Easier applications for loans and credit

- The access to data or new features could mean new ways to better manage your budgets

- Greater data access leading to increased competition between financial institutions leading to product innovation or improvements in tailoring and personalising products

Data Security

Sharing your data is secure. Stringent security standards are in place for accessing and storing customer data and will be subject to the Privacy Act. Authorised organisations will only be able to access data with customer consent as requested. For more information as to how Police Credit Union handles your data, please view our Privacy Policy.

Who can access CDR data?

Customers can only allow an ADR to access their Police Credit Union shared data if they:

- are an individual account holder;

- are at least 18 years of age; and

- have at least one account with Police Credit Union, which can be viewed via Online Banking or via the Banking App.

View and Amend your Data Sharing Consents

As part of the CDR, Third Parties / ADRs can view data from these product types:

- Savings accounts

- Credit cards

- Mortgages

- Personal Loans

The CDR data that is available for data sharing with ADRs includes:

- Customer data – name, contact details and occupation (if they are an individual) and the organisation profile and contact details (if they are a business).

- Account data – account name, type, balance, number, features, direct debits, scheduled payments and saved payees.

- Transaction data – account data like transaction details.

- Product specific data – product information relevant to the account, type, name, price, associated features and benefits, terms, conditions and eligibility requirements.

Please note: data relating to joint accounts is not currently available but will be available in the future.

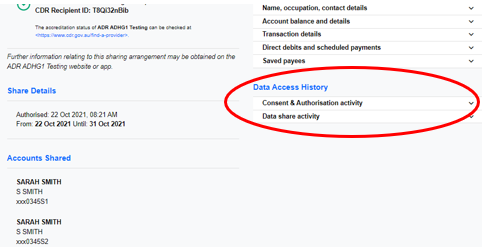

View your Data Sharing History and Consent

View when consent was granted in Online Banking or amend/revoke consent

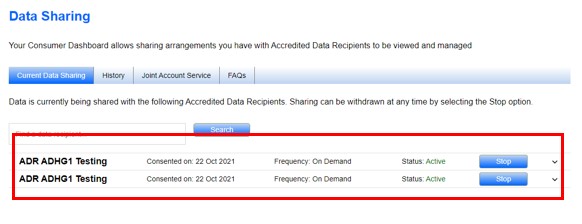

Step 1: Login to Online Banking, select Data Sharing and click on the Current Data Sharing tab to view when consent was granted, the frequency of when Data has been authorised, and the status of the access (active or stopped).

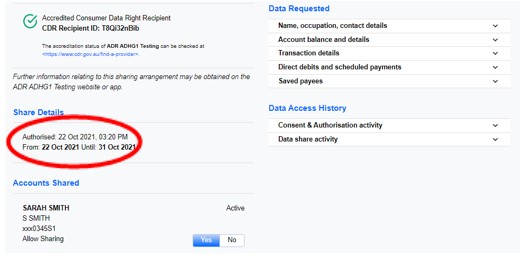

Step 2: After access is granted, click on the down arrow to view details about consent to access, such as, the Account Authorisation validity details.

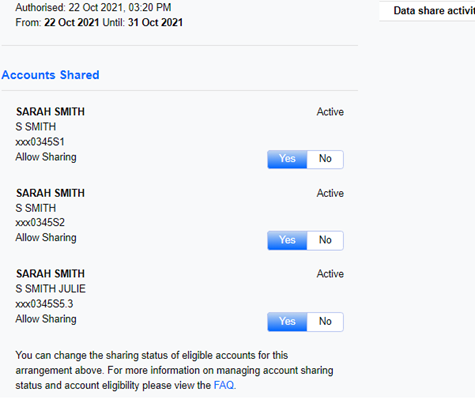

Step 3: You can easily see and amend which accounts you have allocated access for Data Sharing. Each account can be individually removed from access.

Stop Sharing and Revoke Access

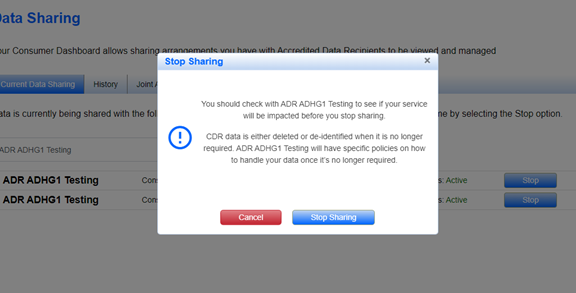

To revoke consent to an ADR, follow steps 1 > 2 > click STOP and the following prompt will ask if you are sure that you wish to stop sharing.

Review Your Data Access History

The History Tab shows CDR Access History i.e. active, suspended, stopped and expired data sharing. Click the down arrows to view and expand the details. View all information which has been shared with an ADR, even if access has been revoked.

Open Banking resources or queries

For more information about the Consumer Data Right, please visit the Australian Competition and Consumer Commission website.

Our current Privacy Policy details how we protect your information.

Accredited Data Recipients

A list of Accredited Data Recipients can be obtained online here.

Our Open Banking Policy

Our Open Banking Policy outlines how we manage your data, along with how you can access and correct your CDR data, or make a complaint if required. You can withdraw your consent to stop sharing your CDR data at any time through your CDR dashboard in Online Banking.

Are you a developer?

Our API link is https://api.policecu.com.au/openbanking/cds-au/v1/banking/products

Get in touch

To find out more, speak to our friendly staff:

Call 1300 131 844 during business hours

Email us at [email protected]

Visit a branch

Mail: PO Box 6074 Halifax Street PO, Adelaide SA 5000

If any of your CDR data is incorrect, please contact us. You can also send a Secure Message via the Inbox in Online Banking or the Banking App. We will not charge any fee for requests to correct customer CDR data.

If you have a complaint or an issue, please read about our complaints process here.